China boasts nine of the world’s 20 largest tech companies, including three in the top 10. The country can claim the world’s largest single-dish radio telescope and several of the fastest supercomputers, and it plans to build the largest supercollider. In 2016, it launched the world’s first quantum communications satellite. The ambitions charted in recent government plans are far-ranging: to excel in areas like 5G mobile technology, seed breeding, and robotics by 2020 and to become a world leader in artificial intelligence by 2030, writes MIT Technology Review.

China has 9 of the world’s 20 biggest tech companies

(Market Cap Bill. $)Dec. 4. 2018 MIT Technology Review)

1 Apple $838B

2 Microsoft $833B

3.Amazon $ 816B

4 Alphabet $735 B

5 Alibaba $407 B

6 Facebook $396 B

7 Tencent $389 B

8 Ant Financial $150B

9 Netflix $120 B

10 Uber$120 B

11 Salesforce $107 B

12 PayPal $99

13 Booking Holdings $86

14 Bytedance $75B

15 Baidu $64 B

16 Didi Chuxing $56B

17 Xiaomi $41B

18 Meituan Dianping $38 B

19 JD.com $31 B

20 Airbnb $31 B

Will go Global

China’s tech giants want to go global. Just one thing might stand in their way.Multibillion-dollar companies like Alibaba and Tencent have thrived thanks to a government that provided incentives but otherwise let them grow. Can they count on that in the future, asks Mara Hvistendahl in an article on December 19, 2018 in the MIT Technology Review.

In the years since, China has undergone a scientific and technological renaissance. Between 1991 and 2016, government funding for research and development grew by a factor of 30. The country overtook Japan in spending on R&D back in 2009. The Organization for Economic Cooperation and Development predicts that it will outspend the United States by 2019. Today Electronics Street is known as Zhongguancun, and it is home to the tech giants Baidu, Didi Chuxing, and Meituan-Dianping, along with research centers for Microsoft, Google, and IBM.

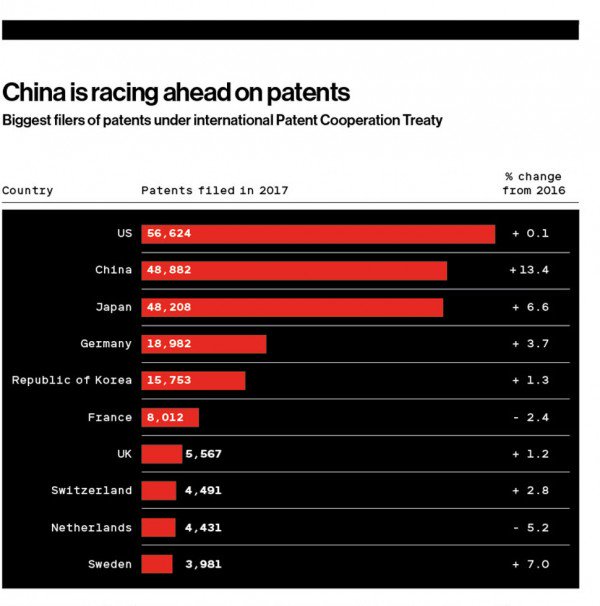

The notion that simply populating China with science parks would lead to progress reflected a government emphasis on quantity and metrics at the expense of quality. Consider the Chinese technology plans. One key plan, adopted in 2006, mapped out growth targets to 2020. By that year, China aimed to spend 2.5% of its GDP on R&D and excel in areas like biotechnology, nanotechnology, and drug development. Other goals included making China one of the top five countries in the world in both invention patents and total number of citations.

Higher Salaries

Some of these targets were reactive: the inclusion of nanotech followed the establishment in 2000 of the US National Nanotechnology Initiative, which provides more than a billion dollars a year in funding for nanoscience research. But they got a Chinese spin. After the 2006 plan was unveiled, local governments rushed to show their support by unveiling incentive schemes. Professors’ salaries depended on how many papers they published in indexed journals. For companies, lucrative innovation subsidies hinged on getting large numbers of patents. Both the national and provincial governments devoted significant sums of cash to attracting back the tens of thousands of Chinese-born researchers living abroad, reasoning that they might jump-start innovation. Grant recipients were offered lucrative resettlement sums, along with salaries far above local norms.

Chinese tech companies have done so well at this sort of experimentation that the direction of copying has reversed, with US tech companies now borrowing ideas from the mainland. The CEO of Kik, Ted Livingston, has said he aims to make the app the “WeChat of the West.” (He got $50 million in financing from Tencent.) Ofo and Mobike have expanded throughout the world, inspiring copycats everywhere—though they have foundered in less densely populated cities where mobile payments aren’t so popular.

Hard work to pick winners

It is this frenetic energy and intense competition, not Chinese government attempts to pick winners and set targets, that is driving innovation in China. Across sectors, the most exciting companies began as renegade startups. Genetic-research powerhouse BGI spun off from the Chinese Academy of Sciences in Beijing, but later moved to freewheeling Shenzhen. Drone maker DJI was founded by a university student working out of his dorm room in Hong Kong. The speech-recognition firm iFlytek was started by a group of PhD students in Anhui province. Small and medium-sized enterprises produce 80% of China’s most innovative products, according to a World Economic Forum white paper.

web design company Dubai, we understand clients’ goals; seek to identify a creative strategy and direction to achieve goals and objectives.

https://www.dowgroup.com/